Mortgage calculator with extra payments starting later

Common monthly debt payments include the likes of. The calculation works by dividing the total cost of your monthly debts by your gross monthly income.

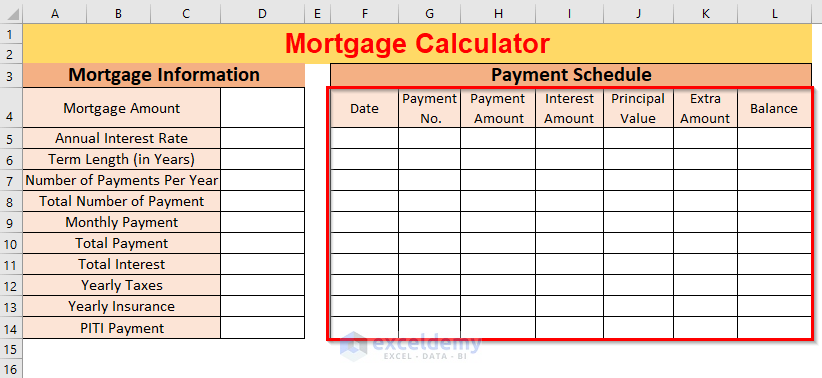

Creation Of A Mortgage Calculator With Taxes And Insurance In Excel

Use our MoneyHelper mortgage affordability calculator to find out how much you can afford to borrow for your new house.

. The debt elimination calculator supports three ways of making extra payments. So you can work this out for yourself. When to consider a refinance of your reverse mortgage.

The extra 5 is covered by insurance. Dba Edina Realty Mortgage. It can be tempting to overpay on your mortgage if you can.

Leave the ending date as is. If youd like to know how to estimate compound interest see the article. See How Finance Works for the compound interest formula or the advanced formula with annual additions as well as a calculator for periodic and continuous compounding.

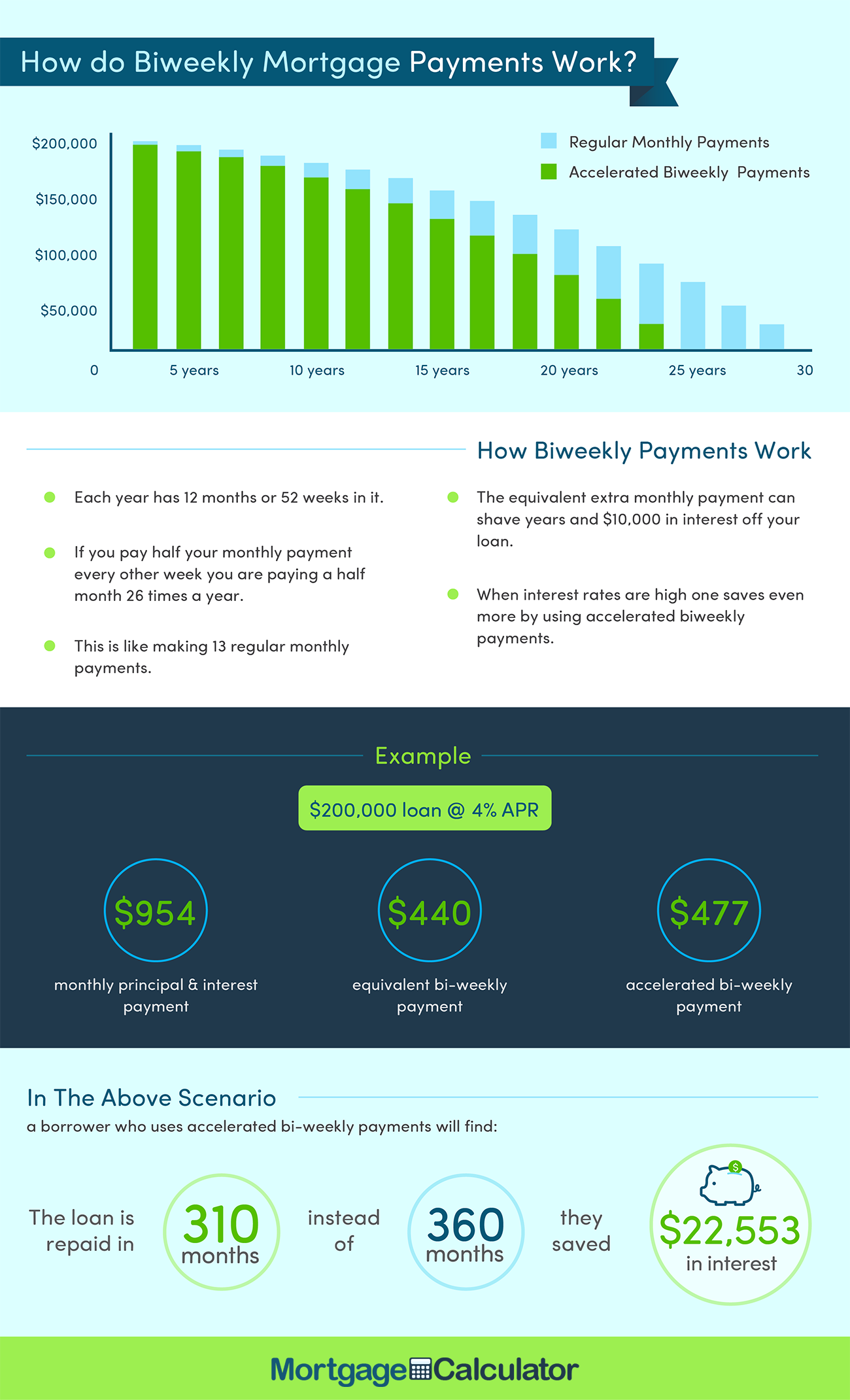

2020 has been a record year for mortgage originations as many homeowners refinanced to take advance of low. Select Jan 2014 for when youll make the extra payment. Youll see that your mortgage will be paid in just 263 months instead of 288 months.

Again Ill paraphrase from the CPFB. 1 To qualify certain conditions must be met. Your home value has increased considerably.

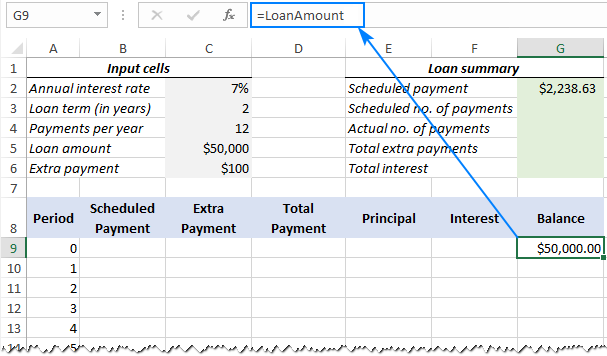

Now press the View Amortization Schedule button. Lets assume that Derek wanted to borrow 100 for two years instead of one and the bank calculates interest annually. Ask for the final cost.

Especially with rates even the most minute change can have a big impact on your estimated mortgage payments. Need help financing a new home or refinancing your current property. At the start youd pay just under 80 then a month later its a tad over 79.

However after a year youd only be repaying a little under 72 a month and the repayments continue to drop meaning the balance reduces more slowly over time while the interest costs continue to. If you have built up a lot of equity in your primary residence maximizing your retirement portfolio may be difficult with the payout limits of government-insured reverse. An amortization schedule is a complete table of periodic loan payments showing the amount of principal and the amount of interest that comprise each payment until the loan.

After the COVID-19 crisis the FOMC dropped the Fed Funds Rate to zero and issued forward guidance suggesting they would not lift rates through 2023. Overpaying could mean lower monthly payments or it might help you pay off your mortgage quicker. The free mortgage calculator is a versatile tool as useful to an individual casually researching properties as it is to someone on the cusp of making a purchase.

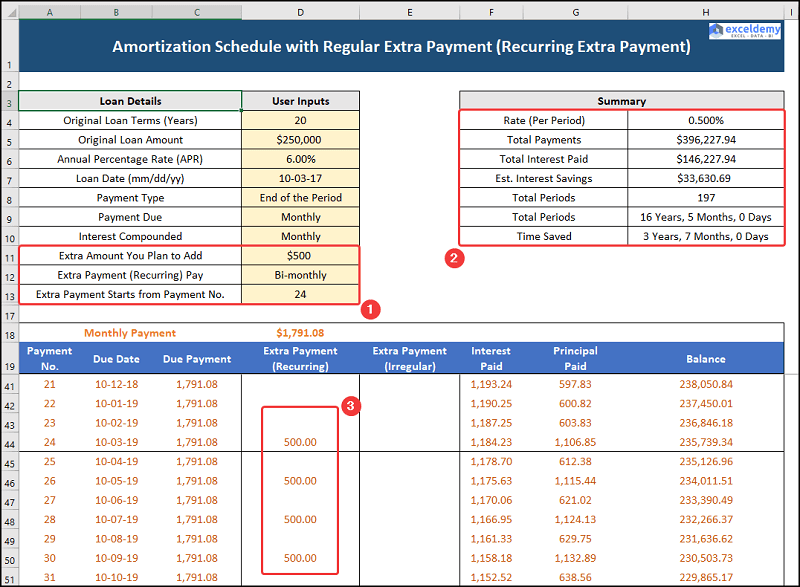

Or you can plan on paying extra amounts in particular months for varying values if you wish. Rent or existing mortgage payments. Her Majesty Queen Elizabeth II 21 April 1926 8 September 2022.

Over the course of a 30-year loan the difference between a 400 interest rate and a 375 interest rate is. But there are things you should think about before you do. Borrowers have the option of paying for mortgage points at closing to get a lower mortgage rate.

Credit cards or store cards. Later on when compound interest has grown your wealth you could make extra payments toward your home loan principal to build more equity. In addition to making extra payments another great way to save money is to lock-in historically low interest rates.

To qualify for a monthly account fee waiver on a new Preferred or Ultimate Package for up to 1 year the Offer you must. You will owe the total debt of the reverse mortgage upon selling or 95 of the appraised value if the debt exceeds the value. You may be charged for overpaying more than your lender allows.

As the table below shows at first theres not much difference. Once you feel your retirement portfolio is in good shape. Derek owes the bank 110 a year later 100 for the principal and 10 as interest.

Get in touch with an Edina Realty Mortgage specialist. Buying down the rate can help reduce your monthly mortgage payments and our mortgage points calculator will give you an idea of how paying points will impact your interest rate and mortgage payments going forward. Find out if there are any fees to increase your mortgage.

This interest is added to the principal and the sum becomes Dereks required repayment to the bank one year later. The interest rate does not include fees charged for the loan. Using our mortgage rate calculator with PMI taxes and insurance.

Learning how to get the best mortgage rate is an important part of getting a home loan. On the Extra Payment tab under Debt Reduction Methods you can enter an additional payment amount that is applied every month. Set a listing price.

A loans interest rate is the cost you pay each year to borrow money expressed as a percentage. 2 No monthly account fees for a year offer conditions. First and foremost your listing price should be based on the amount you owe on your reverse mortgage balance as given in your due and payable letter.

All first mortgage products are provided by Prosperity Home Mortgage LLC. The AAG Advantage Jumbo Reverse Mortgage. Just make sure the year is later than the extra payment year.

Ask whether you have to borrow over the full term of the mortgage or if you can borrow over a shorter term. Open a new or transfer an existing Eligible Mortgage as defined below which is approved and funded between April 1 2022 and September 30 2022. Overpayments reduce your mortgage balance and will save you interest.

The annual percentage rate is the cost you pay each year to borrow money including fees expressed as a percentageTherefore the APR is basically the rate-of-return earned by the. The AAG Advantage Jumbo Reverse Mortgage is AAGs privately offered reverse mortgage intended exclusively for owners of high-value homes. Work out the cost of any extra borrowing with our Mortgage calculator remember to factor in the effect of an increase in the interest rate.

It will not affect the calculation. You originally obtained your loan when the lending limit was less than the 2022 Home Equity Conversion Mortgage HECM limit of 970800 and your value is at or higher than the HUD limit especially the limit that was in effect at the time you closed your loan. 100 10 110.

Find a mortgage expert in your area.

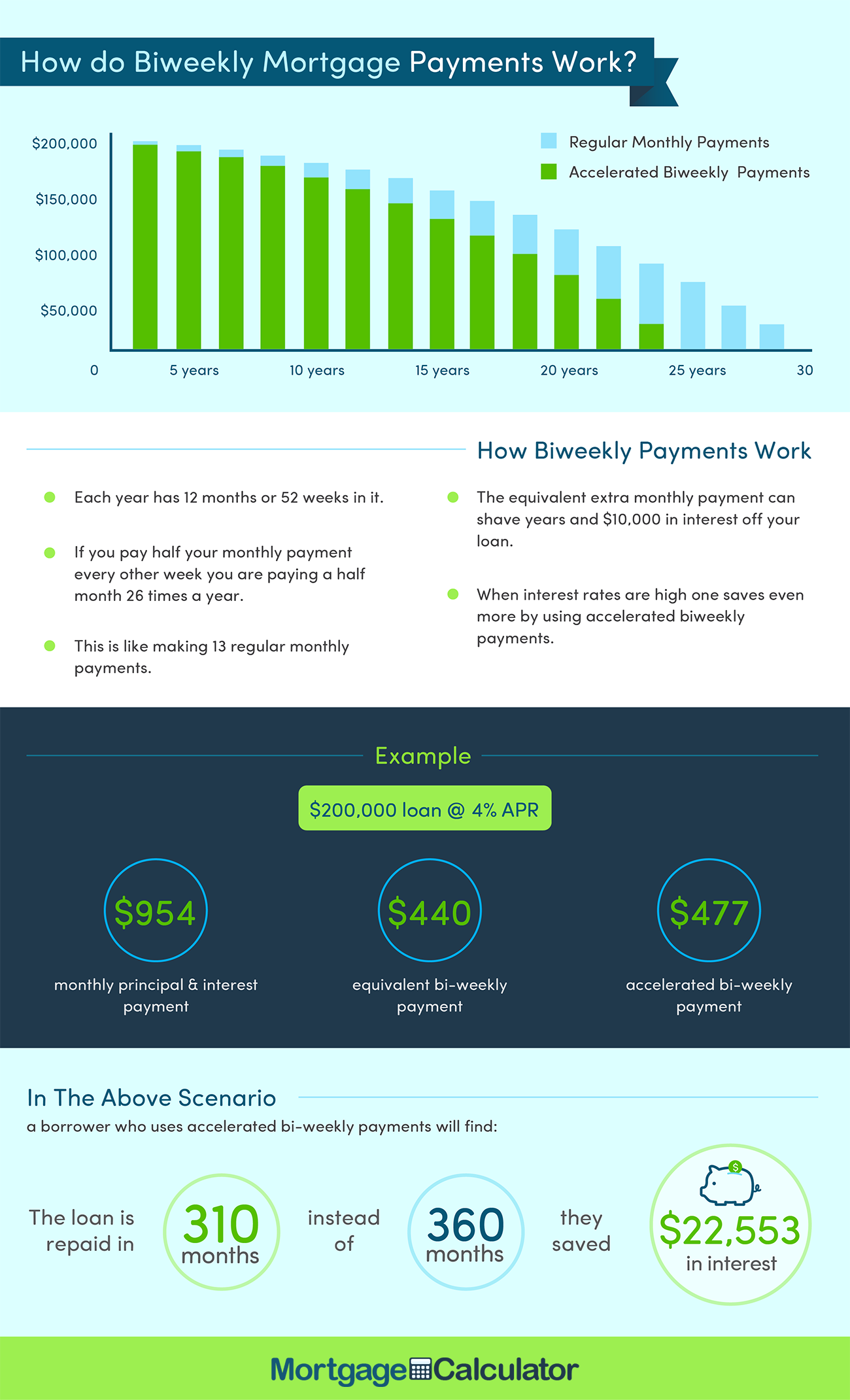

Biweekly Mortgage Calculator How Much Will You Save

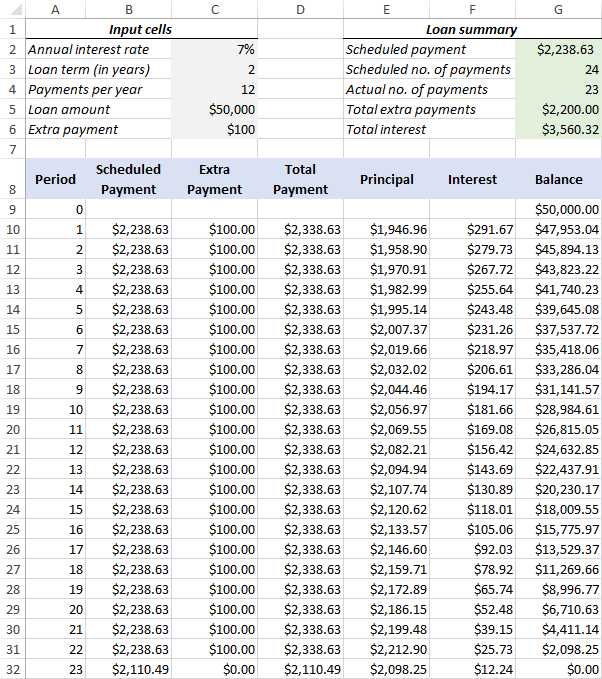

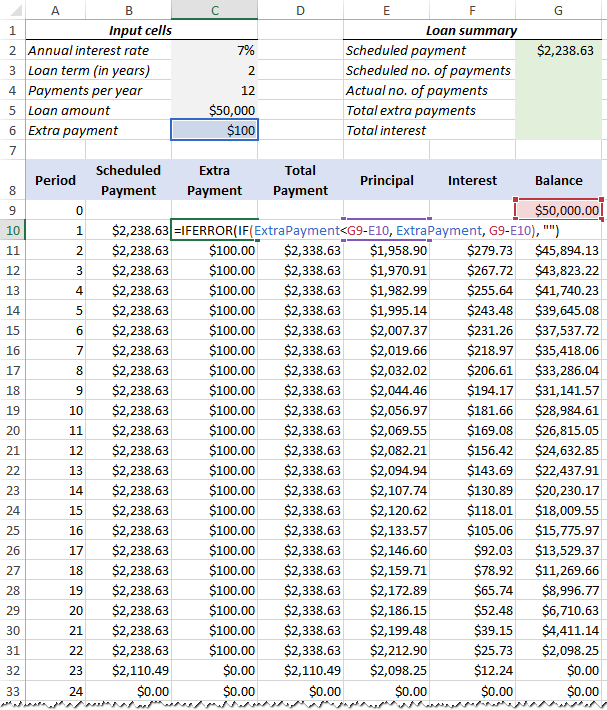

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Amortization Schedule With Irregular Payments In Excel 3 Cases

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Extra Payment Calculator Is It The Right Thing To Do

Extra Payment Calculator Is It The Right Thing To Do

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Should You Make Extra Mortgage Payments Compare Pros Cons

Mortgage Calculator With Extra Payment Youtube

Extra Payment Calculator Is It The Right Thing To Do

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Loan Calculator With Extra Payments Mycalculators Com

How To Create A Loan Amortization Schedule In Google Sheets Ms Excel Youtube

Mortgage With Extra Payments Calculator

Extra Payment Calculator Is It The Right Thing To Do